Time Series Analysis

This a tutorial for Time Series Analysis with real-world data from my Ph.D. Inluding:

- Time Plot, Seasonal Plot, Box Plot

- Seasonality, Trend

- Seasonal Subseries Plots

- Time Series Decomposition

- Detrend

- Stationarity

- Autocorrelation

- Moving Average, Expanding and Exponentially Weighted Moving Average

- Double and Triple Exponential Smoothing

- Simple forecasting methods

import numpy as np

import pandas as pd

import statsmodels.api as sm

from statsmodels.tsa.stattools import adfuller, kpss, acf, grangercausalitytests

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf,month_plot,quarter_plot

from scipy import signal

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

sns.set_style("whitegrid")

plt.rc('xtick', labelsize=15)

plt.rc('ytick', labelsize=15)

data = pd.read_csv('SoleaTimeSeriesDataset-Temperature-Salinity.csv')

data['year_month'] = pd.to_datetime(data['year_month'])

data['year'] = data['year_month'].dt.year

data['month'] = data['year_month'].dt.month

data.head()

| id | obs_id | year_month | temperatureSurface | temperature100_300 | temperature300_400 | temperature100_500 | temperatureMaxDepth | salinitySurface | salinity100_300 | salinity300_400 | salinity100_500 | salinityMaxDepth | year | month | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 02008-01 | 0 | 2008-01-01 | 15.713940 | 13.886082 | 13.886082 | 13.088567 | 12.823628 | 37.147140 | 38.262170 | 38.262170 | 38.560493 | 38.584150 | 2008 | 1 |

| 1 | 02008-02 | 0 | 2008-02-01 | 14.792473 | 13.868667 | 13.868667 | 13.081740 | 12.822814 | 37.084457 | 38.264230 | 38.264230 | 38.563950 | 38.584694 | 2008 | 2 |

| 2 | 02008-03 | 0 | 2008-03-01 | 14.733397 | 13.963535 | 13.963535 | 13.082810 | 12.824340 | 36.935814 | 38.210846 | 38.210846 | 38.561314 | 38.586860 | 2008 | 3 |

| 3 | 02008-04 | 0 | 2008-04-01 | 15.850550 | 13.979778 | 13.979778 | 13.139173 | 12.829004 | 37.155983 | 38.196102 | 38.196102 | 38.553448 | 38.589336 | 2008 | 4 |

| 4 | 02008-05 | 0 | 2008-05-01 | 18.497694 | 13.637879 | 13.637879 | 13.128523 | 12.827576 | 37.341560 | 38.253180 | 38.253180 | 38.548040 | 38.588478 | 2008 | 5 |

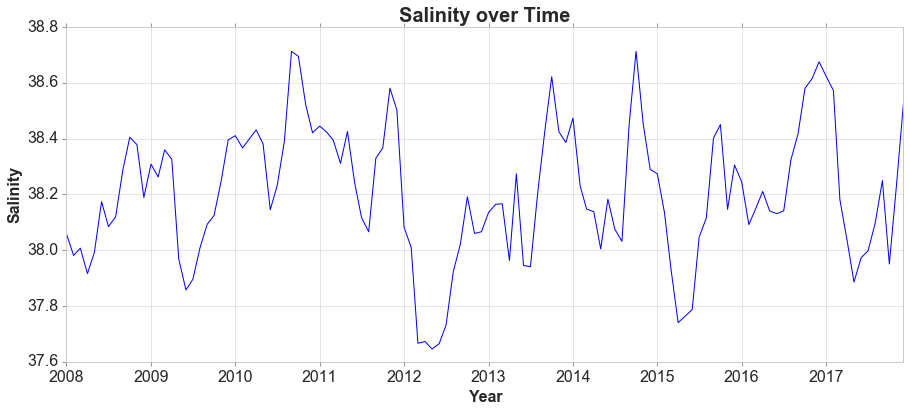

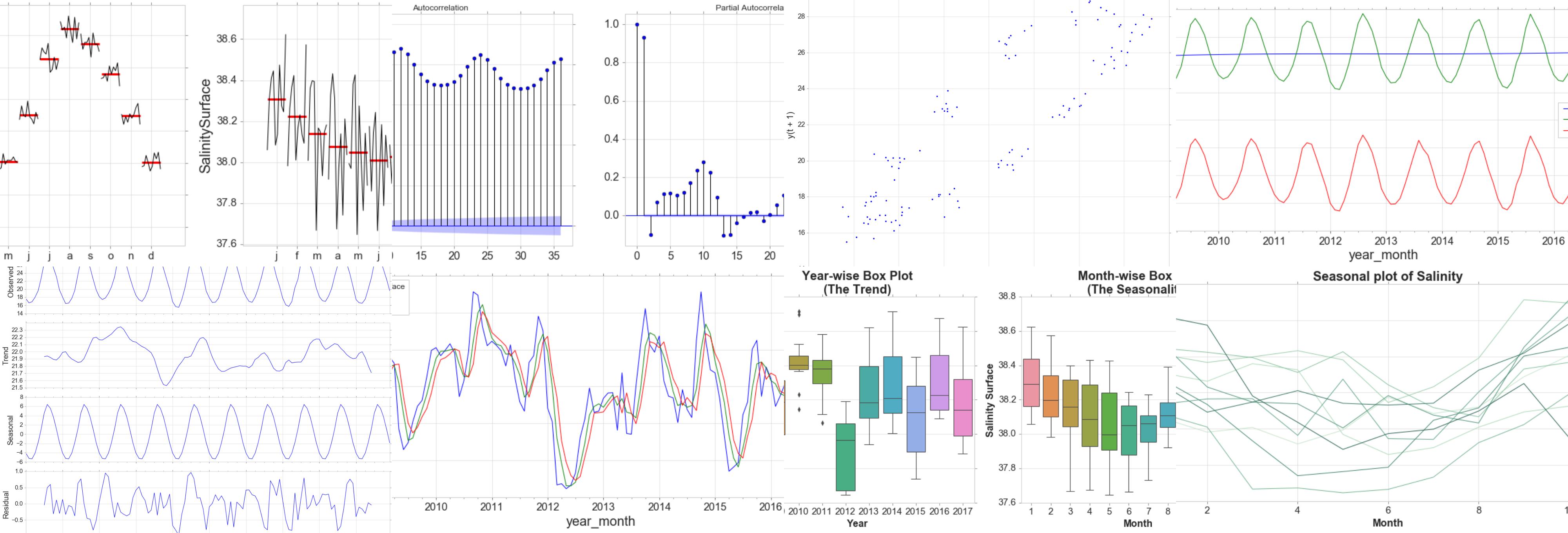

Time Plot

For time series data, the obvious graph to start with is a time plot. That is, the observations are plotted against the time of observation, with consecutive observations joined by straight lines.

fig, ax = plt.subplots(figsize=(15, 6))

d = data[data['obs_id']==2]

sns.lineplot(d['year_month'], d['salinitySurface'] )

ax.set_title('Salinity over Time', fontsize = 20, loc='center', fontdict=dict(weight='bold'))

ax.set_xlabel('Year', fontsize = 16, fontdict=dict(weight='bold'))

ax.set_ylabel('Salinity', fontsize = 16, fontdict=dict(weight='bold'))

plt.tick_params(axis='y', which='major', labelsize=16)

plt.tick_params(axis='x', which='major', labelsize=16)

ax.yaxis.tick_left() # where the y axis marks will be

The monthly data show strong seasonality within each year. There is no cyclic behavior and no trend.

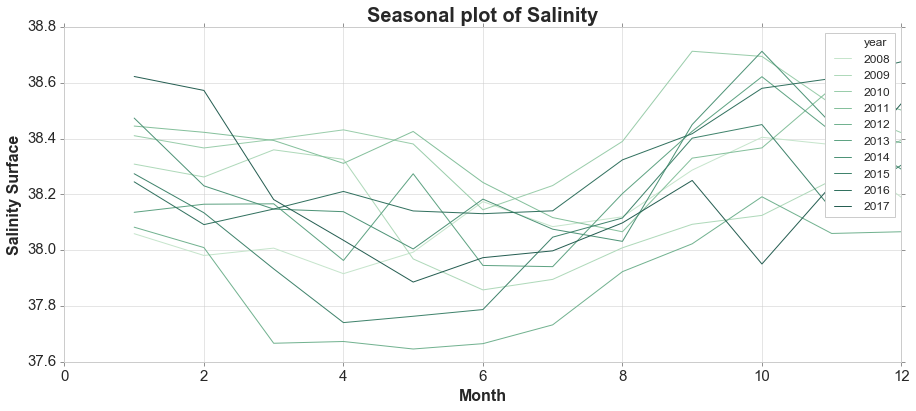

Seasonal Plot and Box Plots

A seasonal plot is similar to a time plot except that the data are plotted against the individual “seasons” in which the data were observed.

variable = 'salinitySurface'

fig, ax = plt.subplots(figsize=(15, 6))

palette = sns.color_palette("ch:2.5,-.2,dark=.3", 10)

sns.lineplot(d['month'], d[variable], hue=d['year'], palette=palette)

ax.set_title('Seasonal plot of Salinity', fontsize = 20, loc='center', fontdict=dict(weight='bold'))

ax.set_xlabel('Month', fontsize = 16, fontdict=dict(weight='bold'))

ax.set_ylabel('Salinity Surface', fontsize = 16, fontdict=dict(weight='bold'))

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(15, 6))

sns.boxplot(d['year'], d[variable], ax=ax[0])

ax[0].set_title('Year-wise Box Plot\n(The Trend)', fontsize = 20, loc='center', fontdict=dict(weight='bold'))

ax[0].set_xlabel('Year', fontsize = 16, fontdict=dict(weight='bold'))

ax[0].set_ylabel('Salinity Surface', fontsize = 16, fontdict=dict(weight='bold'))

sns.boxplot(d['month'], d[variable], ax=ax[1])

ax[1].set_title('Month-wise Box Plot\n(The Seasonality)', fontsize = 20, loc='center', fontdict=dict(weight='bold'))

ax[1].set_xlabel('Month', fontsize = 16, fontdict=dict(weight='bold'))

ax[1].set_ylabel('Salinity Surface', fontsize = 16, fontdict=dict(weight='bold'))

<matplotlib.text.Text at 0x1faa0114a90>

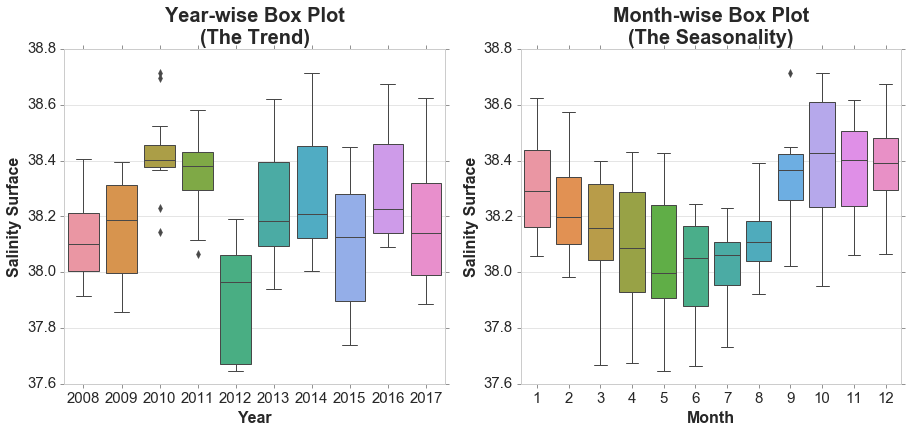

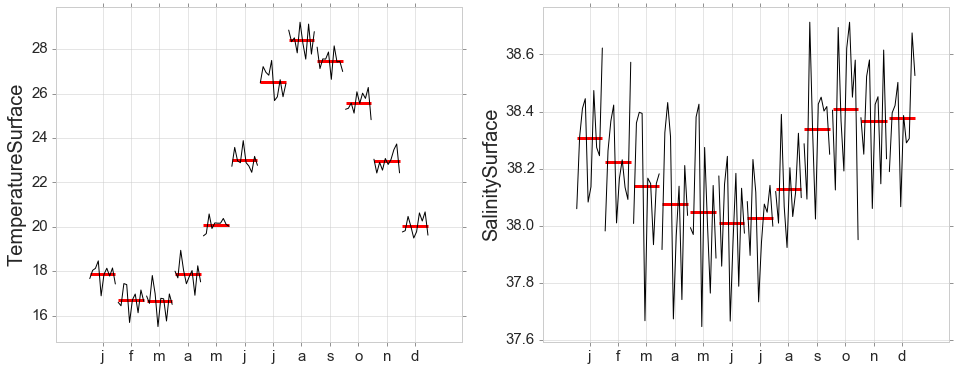

Seasonal Subseries Plots

y = data[data['obs_id']==2][['year_month','temperatureSurface','salinitySurface']]

y = y.set_index('year_month')

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

month_plot(y['temperatureSurface'],ylabel='TemperatureSurface', ax=ax[0]);

month_plot(y['salinitySurface'],ylabel='SalinitySurface', ax=ax[1]);

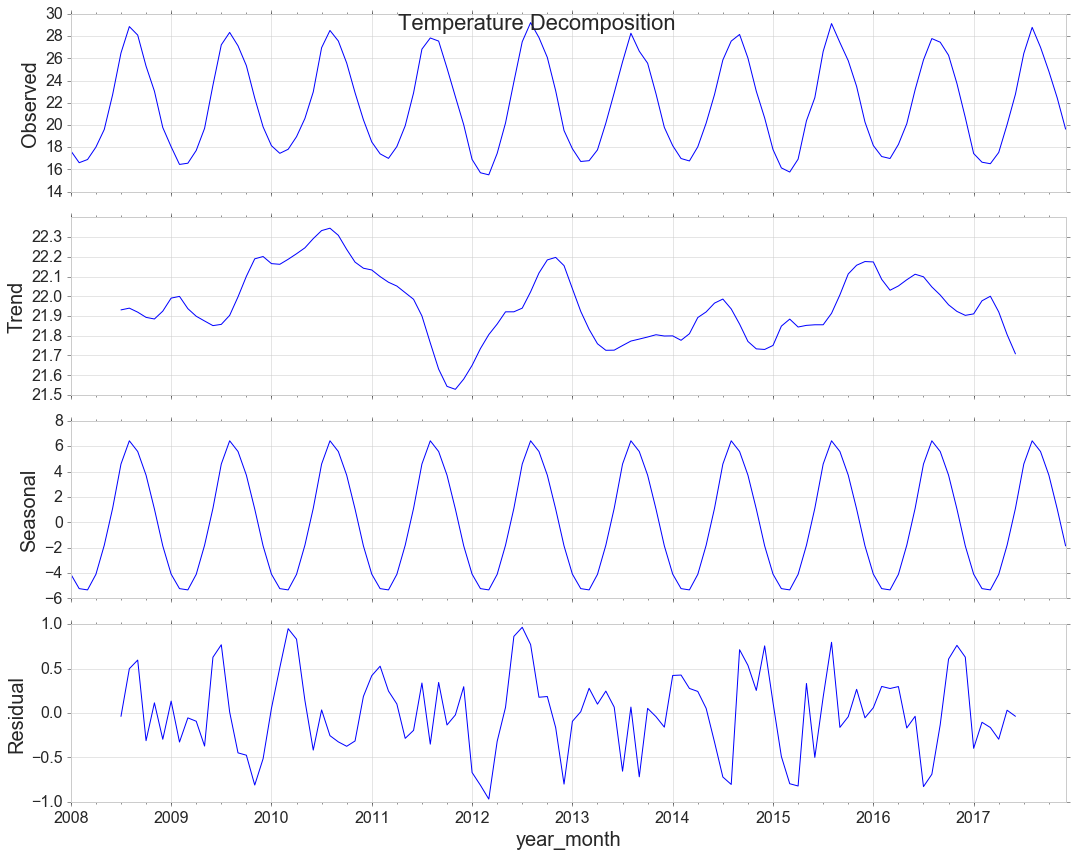

Decomposition

y = data[data['obs_id']==2][['year_month','temperatureSurface']]

y = y.set_index('year_month')

from pylab import rcParams

rcParams['figure.figsize'] = 15, 12

rcParams['axes.labelsize'] = 20

rcParams['ytick.labelsize'] = 16

rcParams['xtick.labelsize'] = 16

decomposition = sm.tsa.seasonal_decompose(y, model='additive')

decomp = decomposition.plot()

decomp.suptitle('Temperature Decomposition', fontsize=22)

<matplotlib.text.Text at 0x1fa9a5cf6a0>

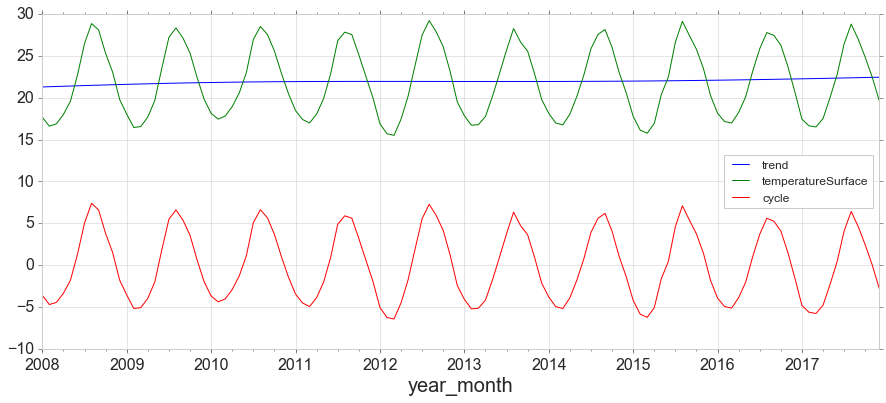

The Hodrick-Prescott filter separates a time-series yt into a trend component τ and a cyclical component ct. For monthly data lambda=129,600.

from statsmodels.tsa.filters.hp_filter import hpfilter

gdp_cycle, gdp_trend = hpfilter(y['temperatureSurface'], lamb=129600)

y['trend'] = gdp_trend

y['cycle'] = gdp_cycle

y[['trend','temperatureSurface','cycle']].plot(figsize=(15,6)).autoscale(axis='x',tight=True);

Measure the strength of trend. 0 for low, 1 for high

max(0,(1-decomposition.resid.var()/(decomposition.resid+decomposition.trend).var())[0])

0.10248782084731933

Measure the strength of seasonality

max(0,(1-decomposition.resid.var()/(decomposition.resid+decomposition.seasonal).var())[0])

0.9880830435213952

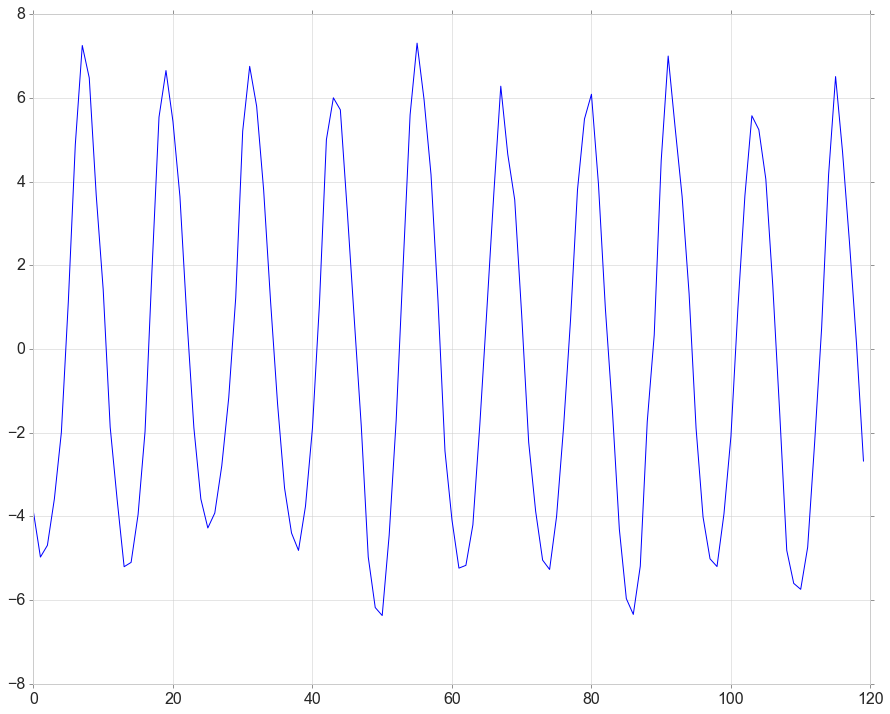

Detrend

detrended = signal.detrend(data[data['obs_id']==2][['year_month','temperatureSurface']]['temperatureSurface'].values)

plt.plot(detrended)

[<matplotlib.lines.Line2D at 0x1fa9f4cdb00>]

Stationarity

from statsmodels.tsa.stattools import adfuller

# check for stationarity

def adf_test(series,title=''):

"""

Pass in a time series and an optional title, returns an ADF report

"""

print('Augmented Dickey-Fuller Test: {}'.format(title))

result = adfuller(series.dropna(),autolag='AIC') # .dropna() handles differenced data

labels = ['ADF test statistic','p-value','# lags used','# observations']

out = pd.Series(result[0:4],index=labels)

for key,val in result[4].items():

out['critical value ({})'.format(key)]=val

print(out.to_string()) # .to_string() removes the line "dtype: float64"

if result[1] <= 0.05:

print("Strong evidence against the null hypothesis")

print("Reject the null hypothesis")

print("Data has no unit root and is stationary")

else:

print("Weak evidence against the null hypothesis")

print("Fail to reject the null hypothesis")

print("Data has a unit root and is non-stationary")

adf_test(data[data['obs_id']==2][['year_month','temperatureSurface']]['temperatureSurface'],title='')

Augmented Dickey-Fuller Test:

ADF test statistic -2.864219

p-value 0.049670

# lags used 10.000000

# observations 109.000000

critical value (5%) -2.888444

critical value (1%) -3.491818

critical value (10%) -2.581120

Strong evidence against the null hypothesis

Reject the null hypothesis

Data has no unit root and is stationary

# KPSS Test

result = kpss(data[data['obs_id']==2][['year_month','temperatureSurface']]['temperatureSurface'].values, regression='c')

print("\nKPSS Statistic: {}".format(result[0]))

print("P-Value: {}".format(result[1]))

for key, value in result[3].items():

print('Critial Values:')

print(" {}, {}".format(key,value))

KPSS Statistic: 0.16268094415564427

P-Value: 0.1

Critial Values:

5%, 0.463

Critial Values:

1%, 0.739

Critial Values:

2.5%, 0.574

Critial Values:

10%, 0.347

c:\users\jim\appdata\local\programs\python\python35\lib\site-packages\statsmodels\tsa\stattools.py:1278: InterpolationWarning: p-value is greater than the indicated p-value

warn("p-value is greater than the indicated p-value", InterpolationWarning)

In the ADF test, the null hypothesis is the time series possesses a unit root and is non-stationary. So because the P-Value is <0.05 we reject the null hypothesis.

The KPSS test, on the other hand, is used to test for trend stationarity. The null hypothesis and the P-Value interpretation is just the opposite of ADH test.

Granger Causality Tests

Essentially we’re looking for extremely low p-values.

grangercausalitytests(data[data['obs_id']==2][['temperatureSurface','salinitySurface']],maxlag=2);

Granger Causality

number of lags (no zero) 1

ssr based F test: F=58.2046 , p=0.0000 , df_denom=116, df_num=1

ssr based chi2 test: chi2=59.7099 , p=0.0000 , df=1

likelihood ratio test: chi2=48.3902 , p=0.0000 , df=1

parameter F test: F=58.2046 , p=0.0000 , df_denom=116, df_num=1

Granger Causality

number of lags (no zero) 2

ssr based F test: F=1.5797 , p=0.2106 , df_denom=113, df_num=2

ssr based chi2 test: chi2=3.2992 , p=0.1921 , df=2

likelihood ratio test: chi2=3.2539 , p=0.1965 , df=2

parameter F test: F=1.5797 , p=0.2106 , df_denom=113, df_num=2

So, one time series is useful in forecasting the other.

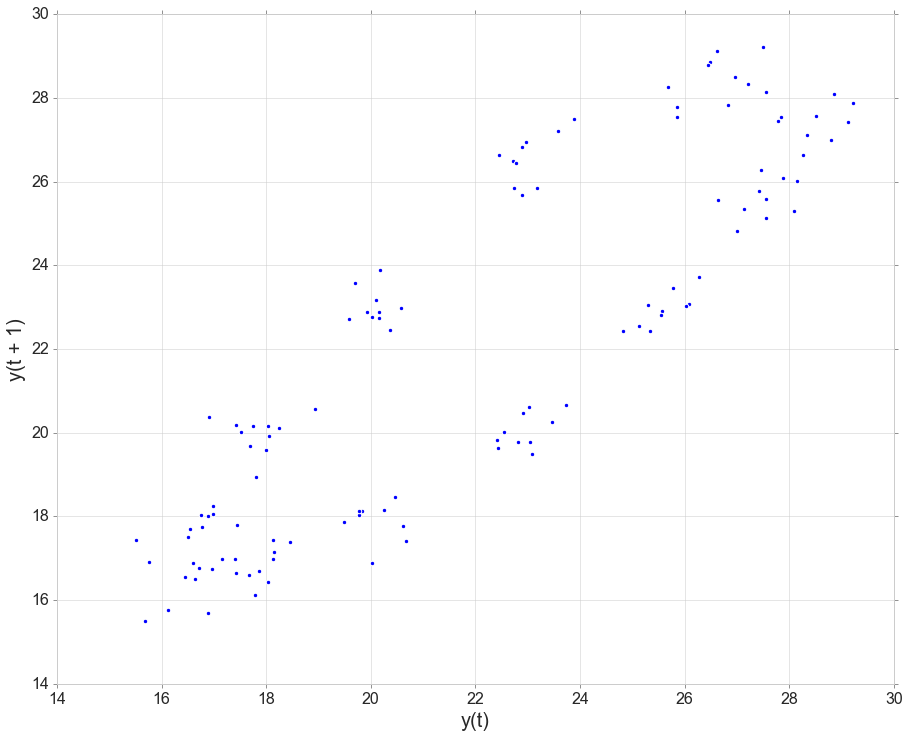

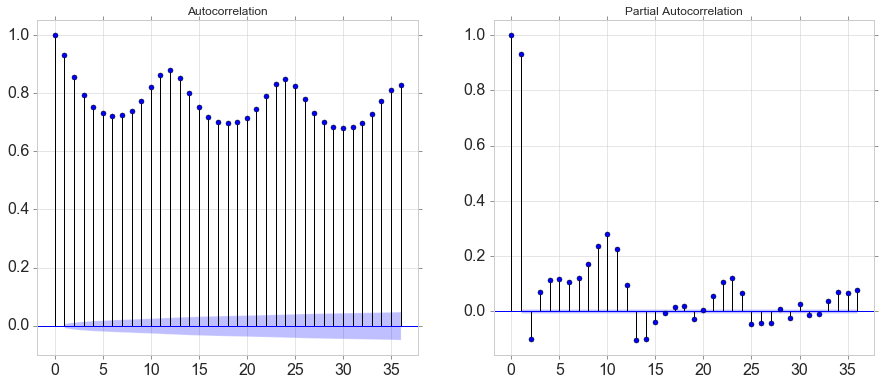

Autocorrelation

# Lag PLots

from pandas.plotting import lag_plot

lag_plot(data[data['obs_id']==2]['temperatureSurface']);

fig, ax = plt.subplots(nrows=1, ncols=2,figsize=(15, 6))

#autocorr = acf(data[variable], nlags=12) # just the numbers

plot_acf(data[variable].tolist(), lags=36, ax=ax[0]); # just the plot

plot_pacf(data[variable].tolist(), lags=36, ax=ax[1]); # just the plot

autocorr

array([1. , 0.9326662 , 0.85668922, 0.79436762, 0.75302265,

0.73118683, 0.72281034, 0.72513455, 0.74072217, 0.77355728,

0.82080037, 0.86408744, 0.88016387])

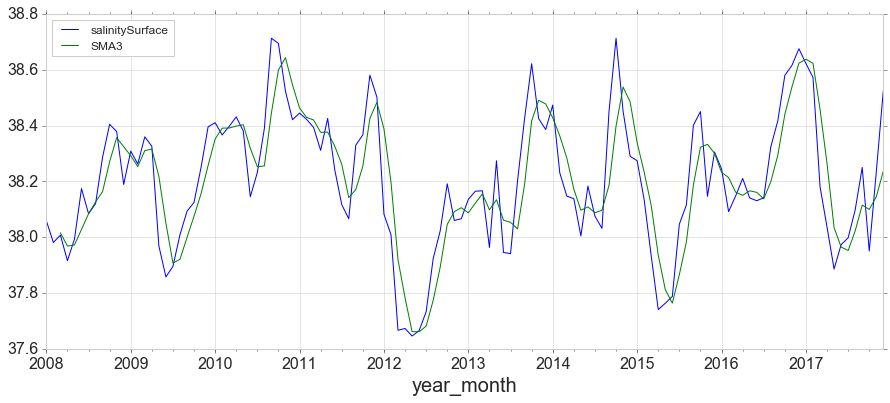

Simple Moving Average, expanding and Exponentially Weighted Moving Average

y = data[data['obs_id']==2][['year_month','salinitySurface']]

y = y.set_index('year_month')

y['SMA3'] = y.rolling(window=3).mean()

y.plot(figsize=(15,6));

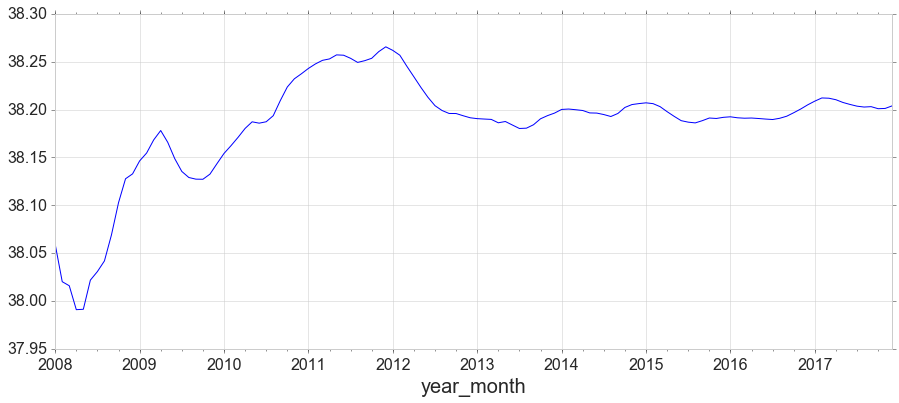

y1 = data[data['obs_id']==2][['year_month','salinitySurface']]

y1 = y1.set_index('year_month')

y1['salinitySurface'].expanding().mean().plot(figsize=(15,6));

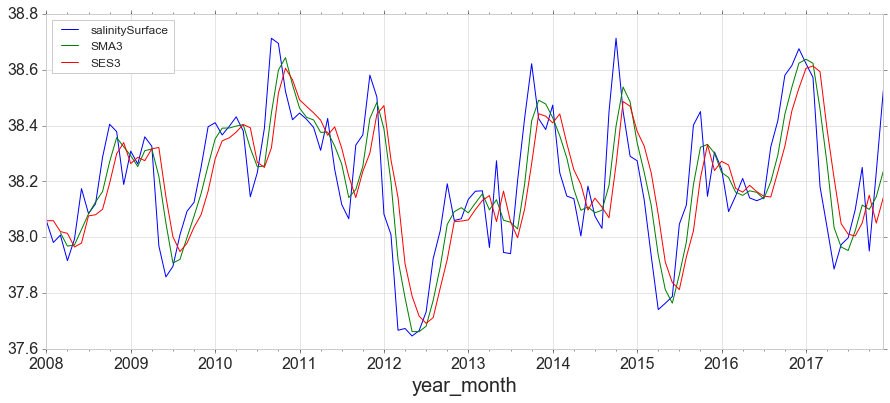

from statsmodels.tsa.holtwinters import SimpleExpSmoothing

span = 3

alpha = 2/(span+1)

y.index.freq = 'MS'

y['SES3']=SimpleExpSmoothing(y['salinitySurface']).fit(smoothing_level=alpha,optimized=False).fittedvalues

y.head()

| salinitySurface | SMA3 | SES3 | |

|---|---|---|---|

| year_month | |||

| 2008-01-01 | 38.059185 | NaN | 38.059185 |

| 2008-02-01 | 37.981125 | NaN | 38.059185 |

| 2008-03-01 | 38.007427 | 38.015912 | 38.020155 |

| 2008-04-01 | 37.915913 | 37.968155 | 38.013791 |

| 2008-05-01 | 37.992910 | 37.972083 | 37.964852 |

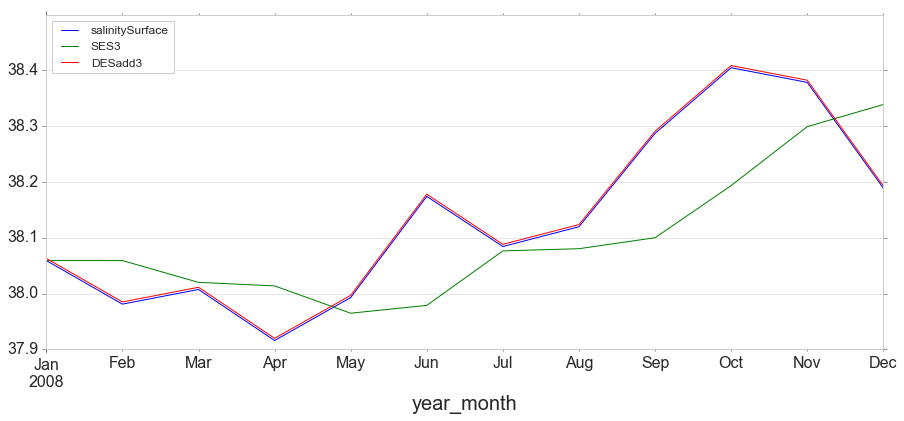

y.plot(figsize=(15,6));

Double Exponential Smoothing

Where Simple Exponential Smoothing employs just one smoothing factor $\alpha$ (alpha), Double Exponential Smoothing adds a second smoothing factor $\beta$ (beta) that addresses trends in the data. Like the alpha factor, values for the beta factor fall between zero and one ($0<\beta≤1$). The benefit here is that the model can anticipate future increases or decreases where the level model would only work from recent calculations.

from statsmodels.tsa.holtwinters import ExponentialSmoothing

y['DESadd3'] = ExponentialSmoothing(y['salinitySurface'], trend='add').fit().fittedvalues.shift(-1)

y[['salinitySurface', 'SES3', 'DESadd3']].iloc[:12].plot(figsize=(15,6));

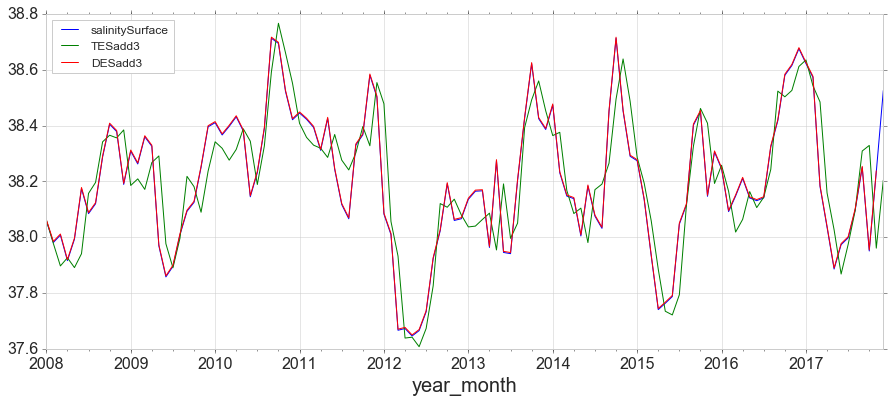

Triple Exponential Smoothing

Triple Exponential Smoothing, the method most closely associated with Holt-Winters, adds support for both trends and seasonality in the data.

y['TESadd3'] = ExponentialSmoothing(y['salinitySurface'],trend='add',seasonal='add',seasonal_periods=12).fit().fittedvalues

y[['salinitySurface', 'TESadd3', 'DESadd3']].plot(figsize=(15,6));

Simple forecasting methods

Average method

Here, the forecasts of all future values are equal to the mean of the historical data.

Naïve method

For naïve forecasts, we simply set all forecasts to be the value of the last observation.

Seasonal naïve method

In this case, we set each forecast to be equal to the last observed value from the same season of the year.

Drift method

A variation on the naïve method is to allow the forecasts to increase or decrease over time, where the amount of change over time (called the drift) is set to be the average change seen in the historical data.

Leave a Comment